Most everyone enjoys a tasty snack of chips and dips. You’d be hard-pressed to find a snack more common and American than this iconic combo. But when it comes to technology, supply chains, and our ability to purchase the products we need, chips and dips are presenting themselves as a nuisance.

Did you know that the average new vehicle contains 12 microchips that power the “brain” of the automobile? And, did you know that the entire globe is currently experiencing a microchip shortage? The COVID-19 pandemic caused a global surge in demand for electronics. Suddenly, business professionals worked from home, students moved to remote learning, and the public stayed home to prevent the pandemic’s spread. A massive increase in sales of personal computers, tablets, tv sets, and game consoles ensued. The demand for microchips that power these devices exceeded the supply. Manufacturers couldn’t make microchips fast enough to keep up.

Dips – Lack of Chips Have Caused Dips in Inventory Levels

The results of these sudden changes in society paired with international trade policies and the outsourcing of manufacturing microchips have led to a shortage – a dip, if you will – of microchips available for electronics and other goods. We’ve all heard, if not experienced, how hard it is to buy high-demand electronics like the Playstation 5, which is due to a scarcity of required manufacturing materials to match the consumer demand. That shortage of microchips has spilled over into the automotive sector, and we see a significant dip in the production of vehicles. Many manufacturers have suspended their factories as there aren’t enough microchips available to finish building inventory. Economists forecast the dips in inventory levels may last well into 2022.

The Bullwhip Effect – A Supply Chain Phenomenon

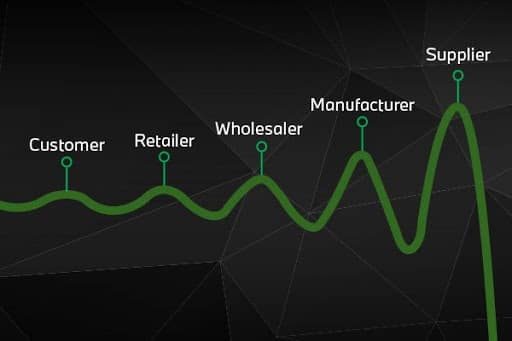

The bullwhip effect is a supply chain phenomenon that explains how fluctuations in demand at the retail level can influence much more significant fluctuations in demand at the wholesale, distributor, manufacturer and raw material supplier levels. The bullwhip effect was named such because of the similarity to the physics involved in cracking a whip. When a person cracks a whip by snapping their wrist, that minor movement causes wave patterns to progressively intensify in a chain reaction as they move down the whip.

Remember March and April of 2020? Consumers panicked and flocked grocery stores and depleted the supply of available toilet paper, cleaning supplies, hand sanitizers and other materials. The lack of availability caused a temporary spike in the cost of these goods.

The 2020 pandemic also caused a bullwhip effect in automotive interest due to the nature of how it played out. Suddenly, many people found themselves driving only a fraction of the miles they had driven pre-pandemic. People worked from home, went out less, and traveling all but came to a halt. Automotive manufacturers cut down on the inventory supplies to match the demand as fewer folks were buying vehicles. They released never-before-seen sales incentives in the form of exceedingly low interest rates to encourage would-be buyers to transact. The inventory built before the shutdown was distressed, and automakers reacted accordingly. However, as time went on and the public began to return to the routines they had before COVID-19, demand for vehicles started to increase.

As vaccines are rolling out, Americans are returning to work and society is opening back up. Many people are eager to get back out and return to some sense of normalcy. Demand for vehicles is returning to levels that existed before the pandemic, but supply hasn’t caught up. Pair that phenomenon with the drops in microchips and automotive manufacturers having to shut down due to lack of supplies needed to roll inventory off the assembly line, a bullwhip effect is imminent.

How Does This Affect You?

Quite simply, if you’ve been looking to buy a car, now is the time to act. We’ve seen what has happened with the real estate market in Utah. The demand for houses outweighs the available inventory. The lack of homes available for purchase has led to bidding wars and inflated prices, making it much more challenging to purchase a property. The same phenomenon is likely to play out in the automotive sector. As inventory becomes scarce, finding the vehicle that you want to buy could prove more difficult. Manufacturers might respond to lower inventory levels by discontinuing the unprecedentedly low APRs and sales incentives they introduced to entice buyers at the beginning of the pandemic.

The good news is, we haven’t reached this point yet. However, it’s possible that this is where we’ll end up. If you’re in the market for a new automobile, we encourage you to take action. The availability of the vehicle you want with low APR offers is available now but is not likely to improve or replicate itself anytime soon.

Don’t let the Chips, Dips, and the Effect of the Bullwhip complicate your purchase journey.